All major indicies except RUT recorded a negative week after FED induced some fears of rate increase, atleast two by end of this year.

SPX: -.68%, COMP: -.37%, DOW: -.85%, RUT: +.10%

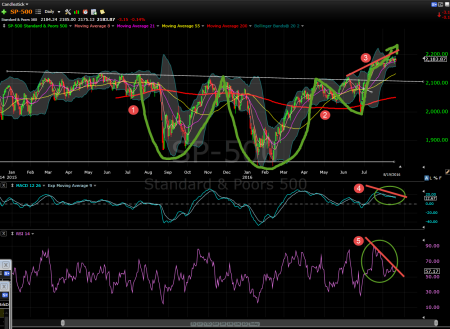

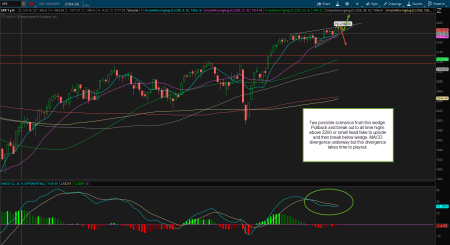

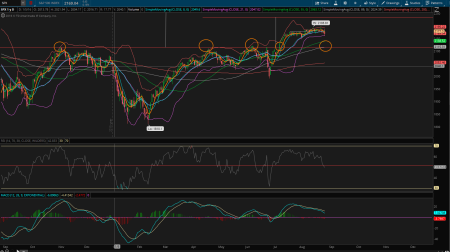

On the daily SPX chart below, I have drawn two boxes to mark price momentum. Price broke into the second box making new highs at 2193.81, then pulled back to the support area which was top of the box marked 1. Price bounced as expected but failed to make new highs. This is a first sign of crack in the bulls armor.

MACD confirming a downward momentum with MAs widening after Friday’s move.

Another closer view of daily SPX purely on price action basis. To me a bullish price action is when price makes higher highs and higher lows. When price fails to make new highs after a bull run but instead makes a lower high and lower its time to pay attention that price momemntum has started shifting. That does not make a case to go outright bearish, but the price momentum shift indicates that new highs might not be in cards for a while. Price is most likely to go sideways to down.

On this chart higher highs and higher lows are marked in dotted green and lower lows and lower highs are marked red.

Also two things to note on the above chart.

- Bollinger Band is now narrowing suggesting possible increase in volatility

- Price closed below 5, 8 and 21 MA. That possibly makes those MAs as potential resistance areas and next support would be the 55 MA (green).

The below chart shows where price broke out on spx (circled). That area has a high probability of revisit and that could also mark a potential buy area for swing.

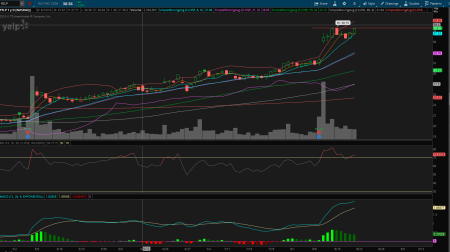

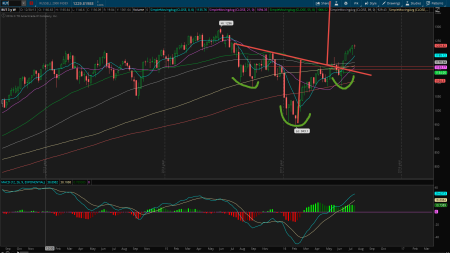

Usually when markets try to make a bullish/bearish moves they tend to develop bullish/bearish patterns in shorter time frames. On the 90min chart below SPX is currently underway to complete a H&S pattern.

Price closed right below neckline (NL) on Friday. A break below 2160 will see this target acquired successfully and a break above 2182 will negate this pattern and bulls take control over this choppy zone again.

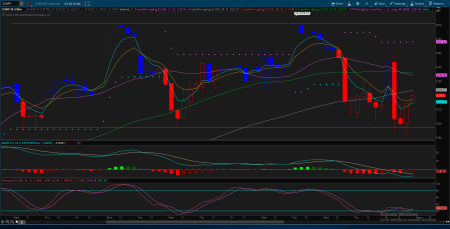

Nasdaq composite shows a possible double top with price testing lower range of the current price consolidation range.

A closer look at the price action on the double top and support/resistance levels.

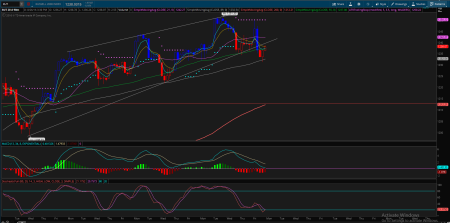

Potential double top with lower low and lower high confirmation on Dow.

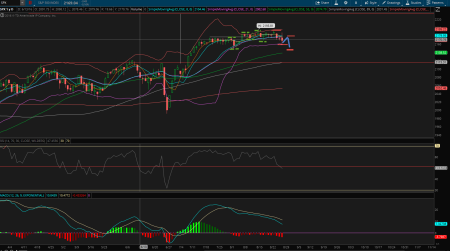

Russell was relatively strong last week and managed to close in green. Daily RUT chart below shows the major support and resistance level for RUT. MACD also confirming a potential double top underway similar to other indicies.

A closer look at RUT’s price action (90m chart) shows a possible break of TL.

Market Internals:

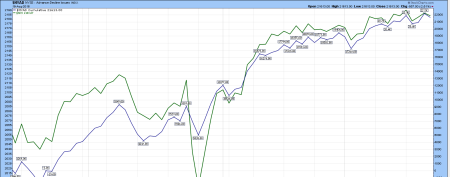

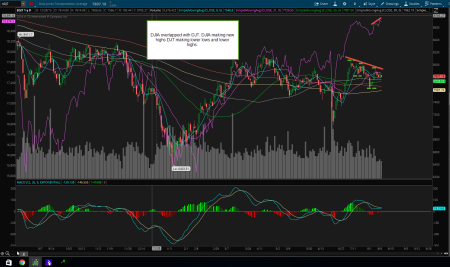

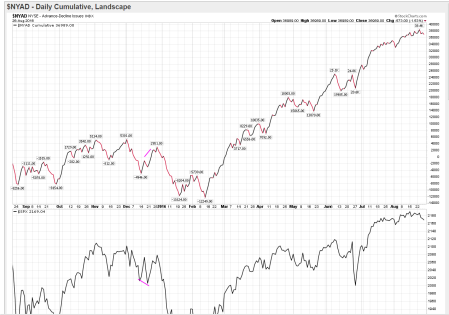

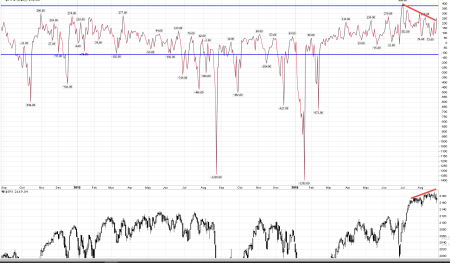

NYSE (Advance decliners) shows a potential pullback is currently underway. NYAD was -12K on Feb lows and now topped at 38K. Both Price and NYAD confirming the pullback.

NYAD a much closer look with SPX overlap. Price action is leading to downside. If most of market leaders start rolling over then AD will catchup and will start leading to downside.

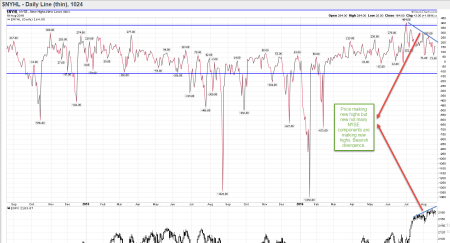

NYSE New high and New Low shows a divergence. When price made new highs, stocks were not making new highs.

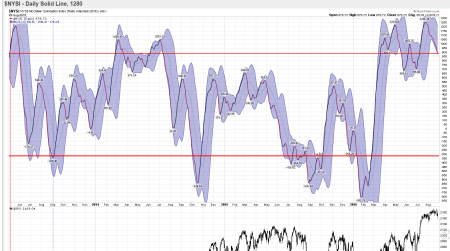

NYSE McClellan Summation index also confirming a down move. Break below 700 level will will see price go down further.

Weekly Vix showing that some fear is creeping in and put protection is being bought. Support at 12 held. One thing to note is that when markets made new highs, Vix never made new lows.

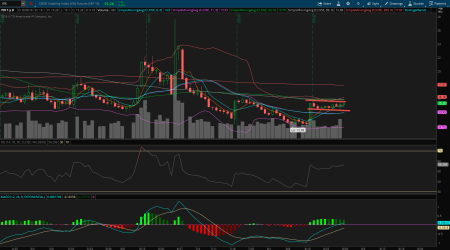

Daily Vx futures showing a bull flag pattern is underway.

Sector update:

Almost all sectors finished in red except for Financials. With a possibility of interest rate raise Financials sector rose as they end up making more money with higher interest rates. On contrary Utilities loose the most on a raising interest rate environment.

Best performing sector

Financials (xlf) : .42%

Worst performing sectors

Healthcare (xlv): -1.73%

Utilities (xlu): -2.23%

Outlook for next week: August is almost over and volatility seems to be coming back into the markets. Friday saw one of the widest price ranges (+27 pts) after 2 weeks of tight trading range.

With Fed hinting at rate increases as a possibility, markets might go into a much needed pullback in September. SPX triggered a bearish H&S pattern and a successful test of target could give bears the much needed ammunition to press it down further.

I’m expecting more of a sideways to down with 2150 as next possible SPx target followed by 2116 which was the breakout area. For this bull market to continue price should break above 2184 area with heavy volume.

Have a great weekend and good trading.

Posted by fibbtrader

Posted by fibbtrader